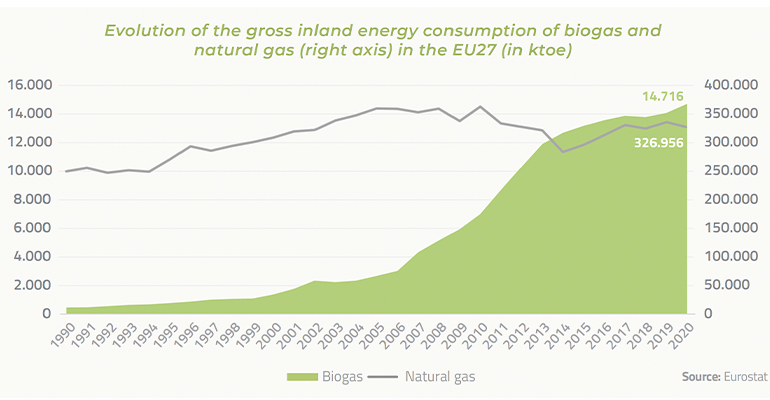

The EU 27 biogas market grew steadily in the previous years, with a growth rate of 4 percent in 2019-2020. However, according to the most recent Eurostat data, the EU still heavily relies on fossil gas. Achieving the EU's ambitious target of 55 percent carbon dioxide emission reductions by 2030 will require fundamental changes to the energy sector and a radical shift in policy design and investments to promote the penetration of renewable alternatives such as biogas and biomethane aka renewable natural gas (RNG), a new Bioenergy Europe report published in collaboration with the European Biogas Association (EBA) finds.

For the fourth time since its launch in 2007, the annual Statistical Report published by Bioenergy Europe is being split into different publications, each one covering a different aspect of bioenergy.

Bioenergy Europe has, in collaboration with the European Biogas Association (EBA), released its 2022 Statistical Report Biogas, the second chapter of its 2022 Statistical Report focusing on biogas and its upgraded version, biomethane aka renewable natural gas (RNG).

The latest trends show a persistent increase in the use of fossil gas since 2014. In 2020 fossil gas was 22.21 times the amount of biogas used.

According to Bioenergy and EBA, these findings call for a “radical shift in policy design and investments” to promote the penetration of renewable alternatives such as biogas and biomethane (RNG) offering a stable and viable substitute to fossil fuels.

This was also recognized in the REPowerEU Plan – the European Commission’s response to the energy market disruption caused by Russia’s invasion of Ukraine.

According to the Commission’s strategy, not only must Europe correct its trajectory in order to become climate neutral by 2050, but it must also disentangle itself from imports from unreliable partners.

Despite these positive steps forward in the recognition of the bioenergy sector, the Commission’s strategy still lacks a clear target for solid biomass on top of those for biogas and biomethane.

Given the current situation, the increasing energy prices and the EU’s higher ambition to get away from fossil fuels, bioenergy as a whole must be recognized as one of the key solutions in order to increase EU energy security and promote a just transition.

The EU should avoid retroactive changes in the Renewable Energy Directive sustainability criteria, allowing for legal certainty for operators. All EU policies should be aligned in the Fit for 55 Package to equally promote all sustainable fuels and their respective infrastructure, said Jean-Marc Jossart, Secretary-General of Bioenergy Europe.

Versatile renewable

Biogas is a versatile renewable fuel that can be used to decarbonize heat or electricity. When upgraded to biomethane (RNG), it can also be injected into the existing gas grid or used as a green fuel in transportation.

Sustainable biogas production also reduces waste and methane emissions from manure and landfilling, and limits dependency on mineral-based fertilizers. This aspect is of particular importance today when considering recent fertilizer shortages and price increases.

Waste and agriculture are the two most important sources of methane emissions today. Biomethane production has more than doubled in the past five years, and last year grew at an annualized rate of 25 percent.

The report stresses that more should be done to promote biogas and biomethane consumption as a complement to renewable electricity and recognize these saved emissions.

To reach the 35 bcm target, as presented in REPowerEU Plan, 5 000 new plants should start operation in the next eight years and the annual growth should be stable at 28 percent.

Feedstock utilized in biogas generation varies greatly by country, with new plants increasingly employing manure and other residues, food waste, wastewater, and sewage sludge.

Starting in 2023, the EU will mandate a separate collection of biowaste, which will increase the amount of food waste available for biogas generation.

The Member States must implement separate biowaste collection as soon as possible and reinforce their strategies aimed at energy and materials recovery in their waste treatment.

Higher quality waste streams will allow for increasing circularity in the bioeconomy, with environmental and socioeconomic benefits.

The European biogas market continues to scale up, with biomethane production growing by 25 percent in 2020. To reach our energy goals, we should anchor the 35 bcm biomethane target to binding EU legislation, along with national indicative targets, and facilitate the injection of biomethane into existing gas networks, said Giulia Cancian, Secretary-General of the European Biogas Association.