The growth of the world’s capacity to generate electricity from solar panels, wind turbines, and other renewable technologies is on course to accelerate over the coming years, with 2021 expected to set a fresh all-time record for new installations. Stronger policies and raised climate goals leading into COP26 are driving renewables to new records, but faster deployment across all key sectors is needed to reach net-zero, says the International Energy Agency (IEA) in new renewables report.

The growth of the world’s capacity to generate electricity from solar panels, wind turbines, and other renewable technologies is on course to accelerate over the coming years, with 2021 expected to set a fresh all-time record for new installations, according to the latest edition of the IEA’s annual “Renewables Market Report“.

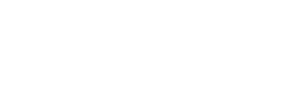

By 2026, global renewable electricity capacity is forecast to rise more than 60 percent from 2020 levels to over 4 800 GW – equivalent to the current total global power capacity of fossil fuels and nuclear combined.

Renewables are set to account for almost 95 percent of the increase in global power capacity through 2026, with solar PV alone providing more than half. The amount of renewable capacity added over the period of 2021 to 2026 is expected to be 50 percent higher than from 2015 to 2020.

This, the IEA says, is driven by stronger support from government policies and more ambitious clean energy goals announced before and during the recently concluded COP26 Climate Change Conference, in Glasgow, Scotland.

This year’s record renewable electricity additions of 290 gigawatts are yet another sign that a new global energy economy is emerging. The high commodity and energy prices we are seeing today pose new challenges for the renewable industry, but elevated fossil fuel prices also make renewables even more competitive, said IEA Executive Director Dr Fatih Birol.

Four markets account for 80 percent of capacity growth

The growth of renewables is forecast to increase in all regions compared with the 2015-2020 period. China remains the global leader in the volume of capacity additions: it is expected to reach 1 200 GW of total wind and solar capacity in 2026 – four years earlier than its current target of 2030.

India is set to come top in terms of the rate of growth, doubling new installations compared with 2015-2020.

Deployments in Europe and the United States (US) are also on track to speed up significantly from the previous five years. These four markets together account for 80 percent of renewable capacity expansion worldwide.

The growth of renewables in India is outstanding, supporting the government’s newly announced goal of reaching 500 GW of renewable power capacity by 2030 and highlighting India’s broader potential to accelerate its clean energy transition. China continues to demonstrate its clean energy strengths, with the expansion of renewables suggesting the country could well achieve a peak in its CO2 emissions well before 2030, said Dr Birol.

Solar PV remains the powerhouse of growth in renewable electricity, with its capacity additions forecast to increase by 17 percent in 2021 to a new record of almost 160 GW.

In the same time frame, onshore wind additions are set to be almost one-quarter higher on average than during the 2015-20 period. Total offshore wind capacity is forecast to more than triple by 2026.

The IEA report expects this record growth for renewables to take place despite today’s high commodity and transport prices. However, should commodity prices remain high through the end of next year, the cost of wind investments would go back up to levels last seen in 2015 and three years of cost reductions for solar PV would be erased.

Global biofuels demand rebounding

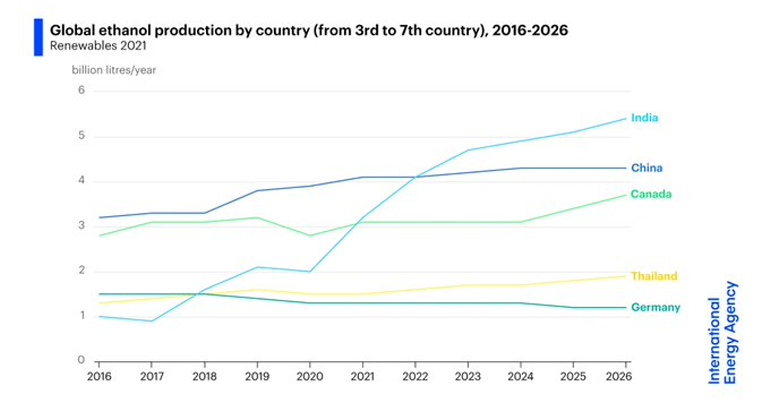

Despite rising prices limiting growth, global biofuel demand in 2021 is forecast to surpass 2019 levels, rebounding from last year’s huge decline caused by the coronavirus (COVID-19) pandemic. Demand for biofuels is set to grow strongly to 2026, with Asia accounting for almost 30 percent of new production.

Renewable diesel demand is expected to nearly triple between 2020 and 2026, primarily thanks to policies in the US and Europe. However, in absolute volume, ethanol demand growth surpasses that of renewable diesel. The majority of renewable diesel growth is concentrated in the US and Europe.

In both regions, renewable diesel competes well in a policy environment that values greenhouse gas (GHG) reductions and places limits on some biofuel feedstocks, as it can be produced with a low GHG intensity using wastes and residues. It has a further benefit in that it can be blended at higher levels than biodiesel.

Ethanol and biodiesel growth remains robust, however, thanks to demand in Latin America and Asia, and recovery from COVID-19 declines. In Asia, India’s efforts to reach 20 percent ethanol blending by 2025, supports global ethanol demand growth, and India is expected to rise to become the third-largest market for ethanol worldwide, behind the US and Brazil.

Indonesia’s 40 percent blending mandate planned for 2022 stimulates biodiesel expansion. In both India and Indonesia, growing transport fuel demand over the forecast period, in combination with mandates, accelerates biofuel demand. Similarly, in Latin America, Brazil’s biofuel policies combined with growing gasoline and diesel demand drive up biofuel use.

Renewable heat needs to step up

Heat is the world’s largest energy end-use, accounting for almost half of global final energy consumption in 2021, significantly more than electricity (20 percent) and transport (30 percent) respectively.

Industrial processes are responsible for 51 percent of the energy consumed for heat, while another 46 percent is consumed in buildings for space and water heating, and, to a lesser extent, cooking. The remainder is used in agriculture, primarily for greenhouse heating.

Global heat demand declined by 2 percent in 2020, primarily due to the curtailment of economic activity as a result of the COVID-19 pandemic, while renewable heat consumption increased by over 3.5 percent year-on-year.

The supply of heat, which contributed more than 40 percent (13.1 Gt) of global energy-related CO2 emissions in 2020, remains heavily fossil-fuel dependent, with renewable sources (including traditional uses of biomass) meeting less than a quarter of global heat demand in 2020 – a share that has remained static during the past three decades.

Global modern renewable heat consumption is expected to increase at a faster rate than heat demand, expanding by a quarter (an increase of 5.4 EJ) in the next five years, with the majority of the growth occurring in the buildings sector.

While the share of modern uses of renewables rises from 11 percent in 2020 to 13 percent in 2026, these investments fall short of containing non-renewable heat consumption. Fossil fuel consumption for heat is forecast to see a 5 percent increase in heat-related CO2 emissions over the outlook period, equivalent to 0.6 Gt CO2.

For comparison, to align with the IEA Net Zero Emissions Scenario, renewable heat consumption would have to progress 2.5 times faster, combined with wide-scale behavioural change and much larger energy and material efficiency improvements in both buildings and industry.

Stronger policies can accelerate growth

Governments can further accelerate the growth of renewables by addressing key barriers, such as permitting and grid integration challenges, social acceptance issues, inconsistent policy approaches, and insufficient remuneration.

High financing costs in the developing world are also a major obstacle. In the report’s accelerated case, which assumes some of these hurdles are overcome, average annual renewable capacity additions are one-quarter higher in the period to 2026 than is forecast in the main case.

However, even this faster deployment would still fall well short of what would be needed in a global pathway to net zero emissions by mid-century.

That would require renewable power capacity additions over the period 2021-26 to average almost double the rate of the report’s main case. It would also mean growth in biofuels demand averaging four times higher than in the main case, and renewable heat demand almost three times higher.